AI-Powered Operating System For Payment Operations and Compliance.

Trusted by Global Payment Leaders

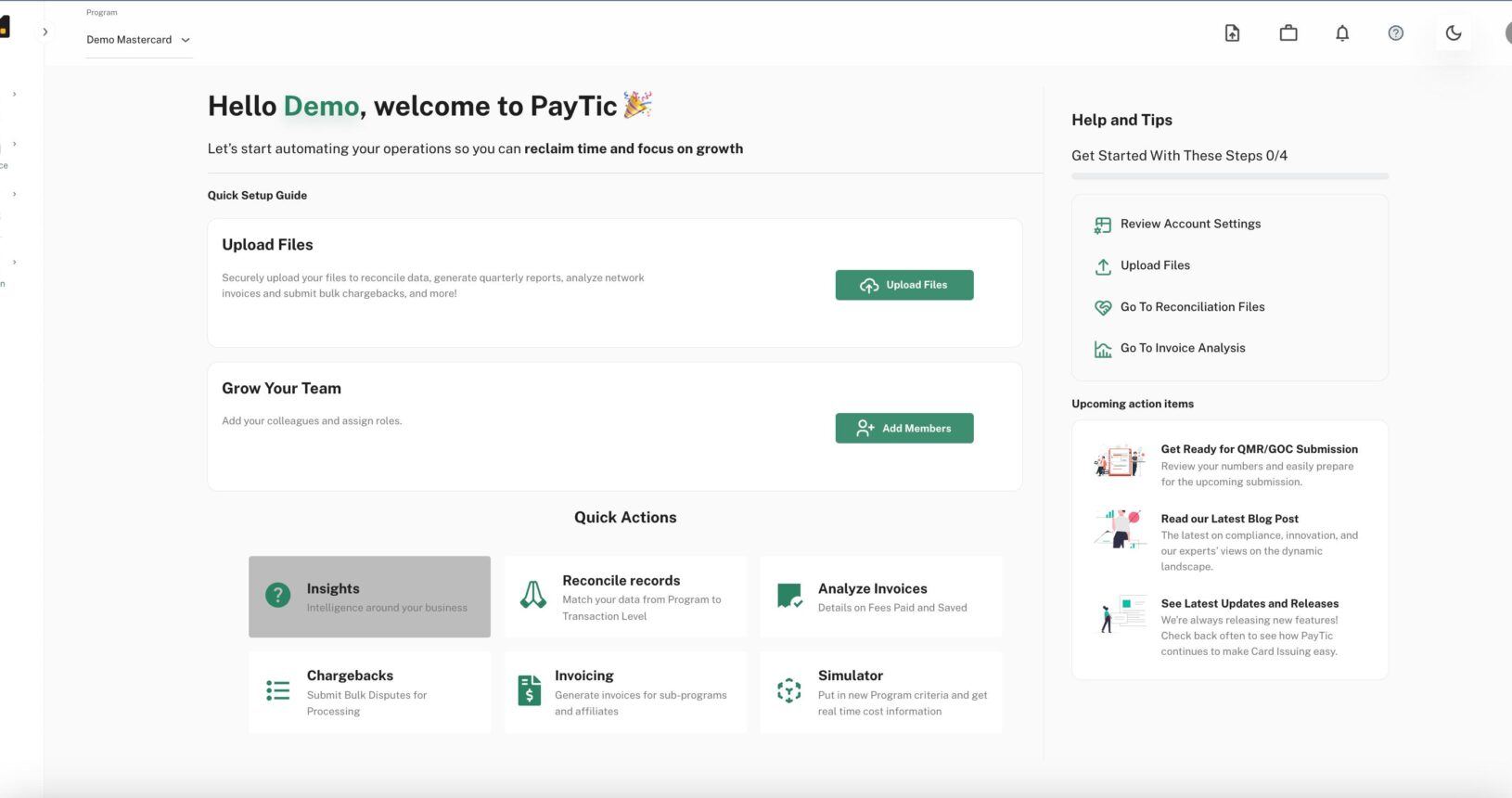

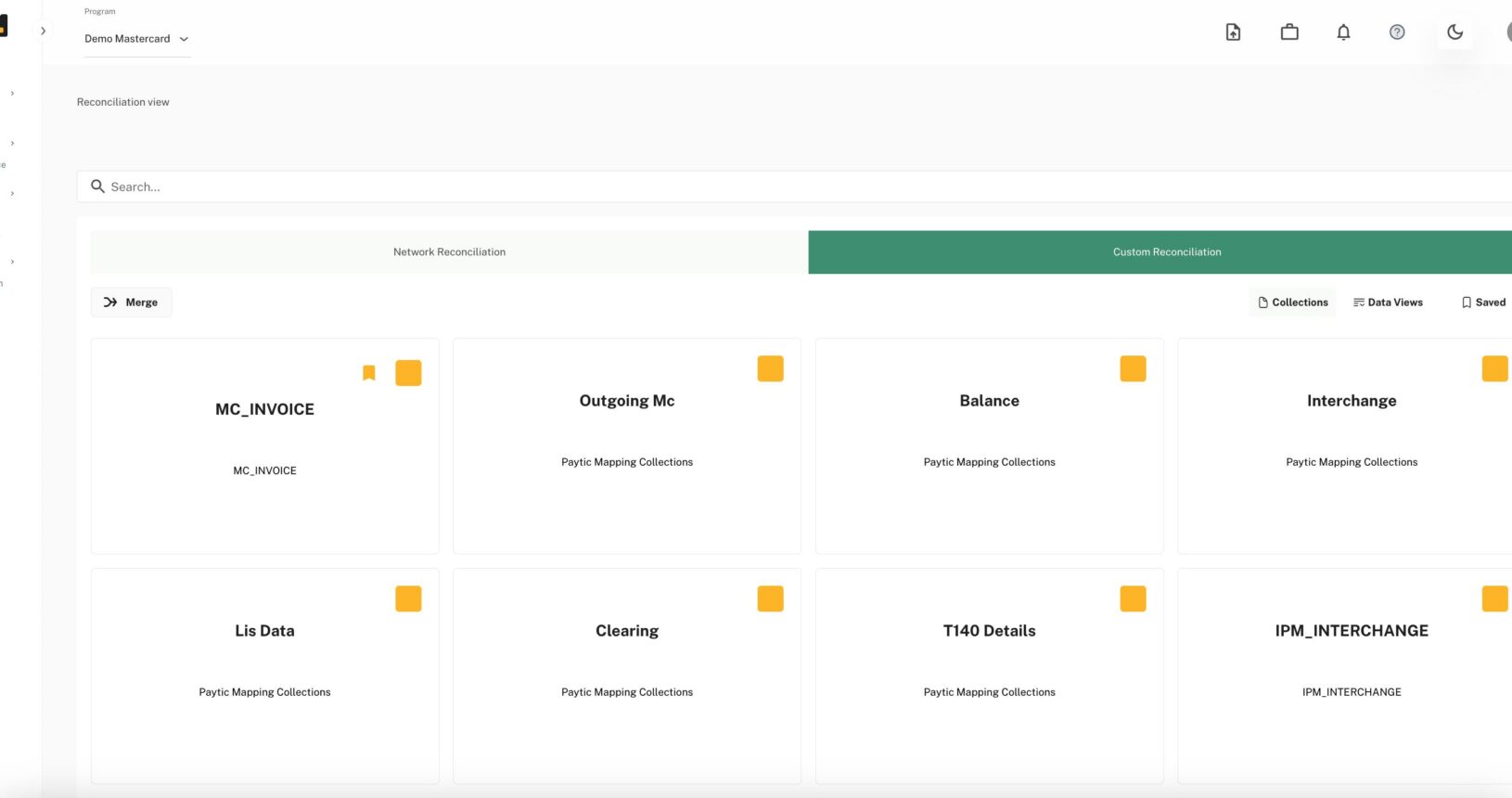

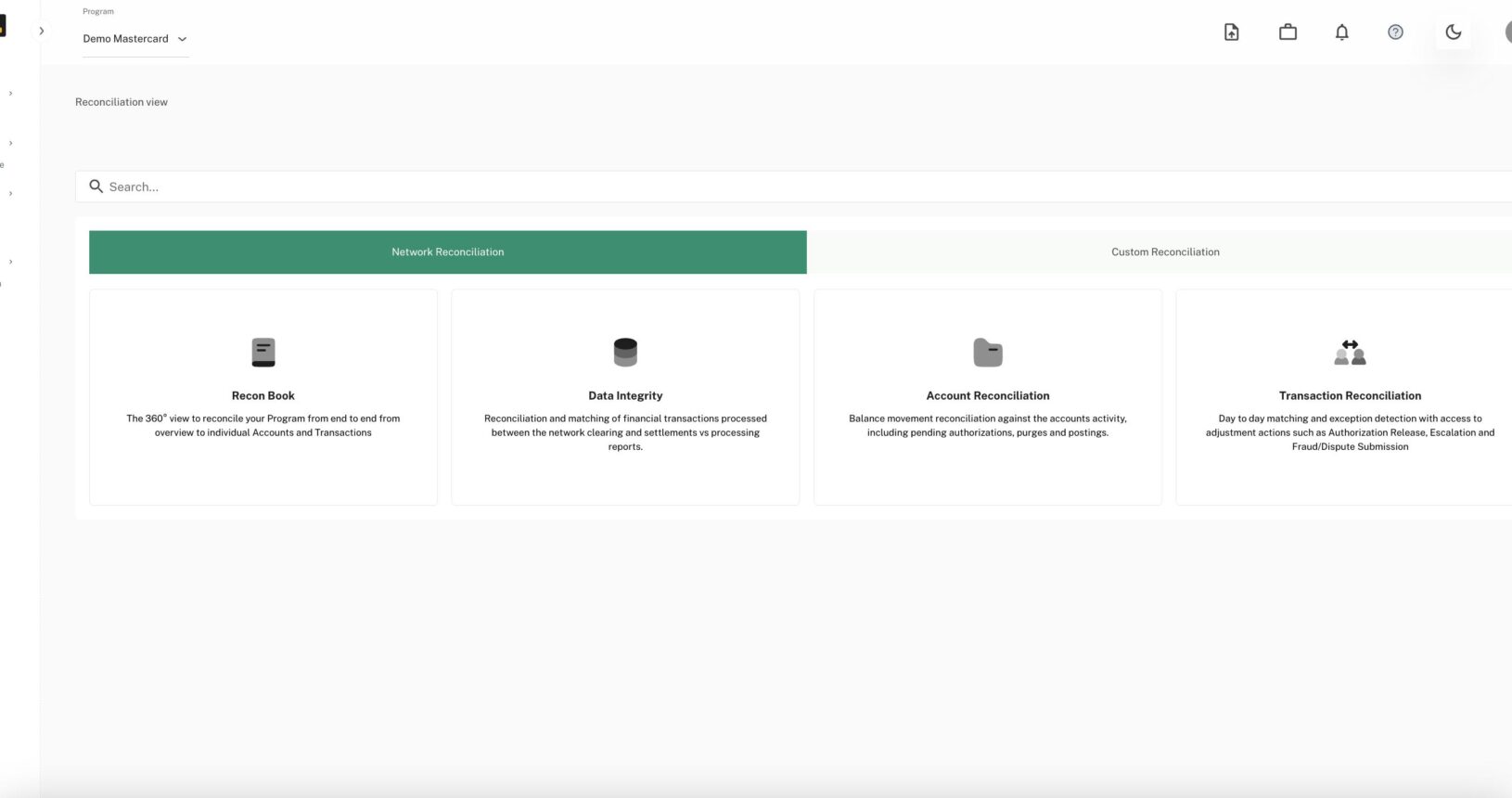

PayTic Functions

Deploy instantly with zero integration overhead

Measurable impact across

every key performance indicator

$ 4M+

Annual Savings

for financial institutions through operational efficiency

98%

Dispute Win Rate

compared to industry average of 60-70%

90%

Reduction

in reconciliation processing time

CLOUD BASED

Implementation made simple—from setup to ongoing management

FEATURES

How We Help You Succeed

Automate

Transform manual reconciliation into automated precision. Our platform eliminates spreadsheets, reduces errors, and cuts processing time by up to 90%.

Optimize

Gain complete visibility into network fees and reduce costs by 10-15% annually. Identify unnecessary charges and optimize your fee structure with real-time analytics.

Scale

Handle 10x more transactions without adding staff. Our drag & drop functionality enables implementation in just 5 days, with immediate ROI.

Discover PayTic

Watch demos, meet our team, and explore the platform that's transforming payment operations

Client Testimonial

PayTic is the most efficient partner for Card Operations! They are fast to communicate and react to our needs, implementation is fast, no hidden costs and the solutions and tools are so useful in freeing our team from daily manual work. My recommendation is to enhance the partnership with PayTic's wonderful team/tech and move towards the full integration as soon as possible.

Eva Liparteliani

Payment Cards Team Manager

We view PayTic as a key enabler to our ability to grow our business. As we add more card programs, we will be sure to have PayTic there to help us manage the back-office program functions.

Susanne Rainhard

Payments Director

PayTic is a valued partner, their expertise, innovative solutions and exceptionally dedicated team have helped us achieve our goals. We look forward to continued collaboration and success together.

Anthony Scolaro

Head of Finance & CCO at Loop

After implementing PayTic, we saw instant efficiency in our operations and a strong ROI within 2 months via savings on our Network Invoices. It was clear for us that a partnership with PayTic put us in a strategically advantaged position for growth. Expanding our contract to more modules was an easy decision

Amine Alaoui

Board member and managing director

Integrated with global payment leaders

![]()